Learn from Sharon

Using Your Intuition to Make Changes: A Guide for Trusting Your Gut

Using Your Intuition to Make Changes: A Guide for Trusting Your Gut We have all had those times when we’ve made a decision and then kicked ourselves for it afterward …

Raising Smart Savers | Sharon Lechter On Your Side Podcast

Raising Smart Savers AZ Family’s On Your Side speaks with Sharon about strategies to raise smart savers and finding fun learning opportunities.

It’s Not Too Late to Discover Your Value | Making a Difference Regardless of Your Age

In my opinion, old is a state of mind. Afterall, there are many people who have done great things and followed new passions well into their 90s! I’ve personally started …

How to Teach Your Kids About Money | Sharon Lechter On Your Side Podcast Interview

On Your Side Podcast Interview Susan Campbell and Gary Harper speak with Sharon on AZ Family’s On Your Side Podcast about strategies to provide your kids with the information …

Fight or Flight: How to Handle the Threats You face

Workplace stress, social threats, dealing with criticism, and financial strain are just some of the areas of life that can trigger our fight or flight response. When it’s an occasional …

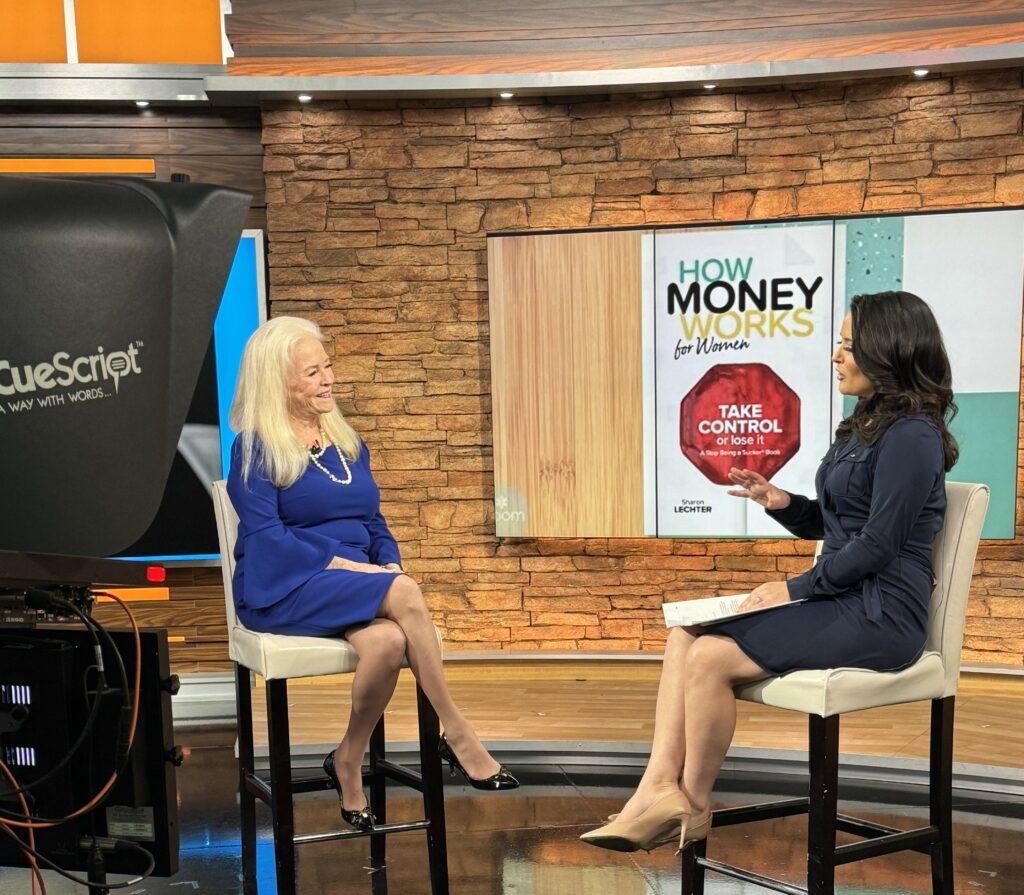

How Money Works for Women | Sharon Lechter on AZ 3 TV Consumer Watch

Sharon Lechter on AZ 3TV Sharon Lechter speaks with Whitney Clark on AZ 3TV’s Consumer Watch about the most important money lessons for women from Sharon’s most recent book, …

Sharon Lechter on Hustle Culture: inBusiness Magazine

Thriving in the Fast Lane: Essential Healthy Habits for Young Professionals to Beat Hustle Culture And a healthy reminder for professionals at any stage of their career. The hustle-and-grind culture …

Setting Boundaries: A Guide to Restricting Access to Your Time and Energy

To be our best, personally and professionally, we must realize that we cannot be all things to all the people in our lives. Consistently giving too much of our time …

Money Mastery: Smart Financial Strategies Tailored for Women in 2024

The unfortunate reality is that many women find themselves at a financial disadvantage as compared to men. We typically make less money, take time off work to care for children, …

Breaking Free: How to Conquer Guilt Before It Drags You Down

Guilt is a feeling that can hold us back from the wonderful and rich lives we deserve. Chronic guilt can even lead to detrimental effects on your overall health and …